The movie theater business is down, but AMC’s share price is up.

Photo: Frederic J. Brown/AFP via Getty Images

Thanks to an unlikely confluence of influences — the rise of cell phone day-trading amid a pandemic, a hive-minded forum willing to fleece a surprisingly transparent hedge fund on behalf of a nostalgic strip-mall staple, and the stock-market advice of a guy known as “DeepFuckingValue” — GameStop’s share price has risen from $17 on January 4 to over $347 as of publication. And as the young, male, politically incorrect users on the subreddit r/WallStreetBets continue to wield the mobile investment app Robinhood as a tool to short squeeze billion-dollar investors anticipating a GameStop crash, they are trying their scheme on other unlikely investments. Below are some of the most dramatic (albeit temporary) stock surges to emerge from the chaos.

The crown jewel in r/WallStreetBets’ meme index fund is the store that bought back used games from children in the Bush years for pennies on the dollar. Spurred by last year’s investment by young start-up mogul, and fueled later by a desire to wreak havoc in an already tumultuous system, the Reddit bettors have sent GameStop’s stock to the moon, from a share price of $39.12 last week to $347.51 on the afternoon of January 27.

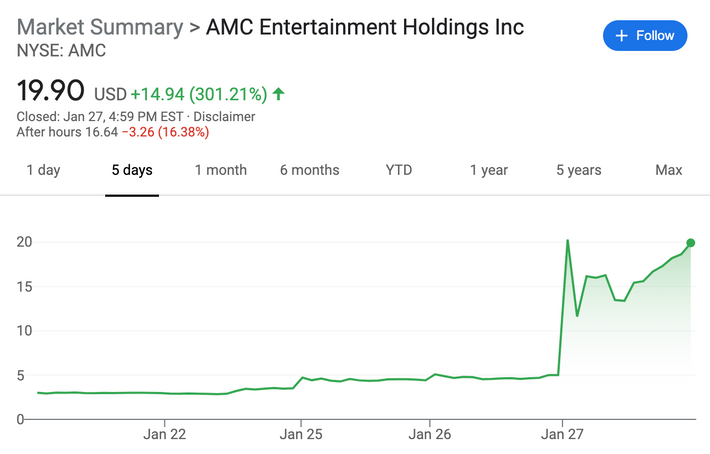

The next firm hit hard by the pandemic to get a boost was the movie chain AMC, which saw its share price rise from $5 on Tuesday to $20.30 by the end of trading on Wednesday.

On Thursday morning, Reddit-fueled stock buyers turned their attention to commodities, following the advice of a recent post in popular WallStreetBets forum, which advised putting a “short squeeze” on silver stocks. (At least one expert thinks this is a smarter bet than past-their-prime retailers.) Several companies in that sector, like First Majestic Silver Corp. saw huge surges, though the fever had begun to cool later in the morning.

Graphic: Google

The cryptocurrency, which began life as a joke, saw gains of more than 140% overnight on Wednesday into Thursday. A Twitter account popular with Reddit speculators boosted the currency with a couple of casual tweets:

The currency speculation cooled slightly on Thursday morning, but Dogecoin’s price was still up by more than 100% as of midday.

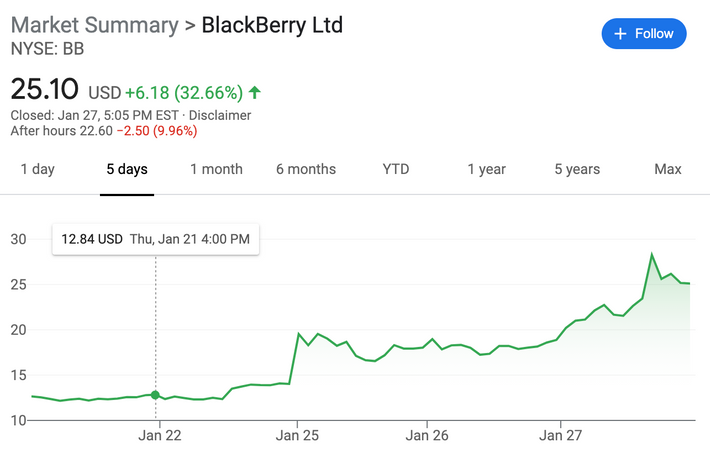

The share price of BlackBerry, one of the hottest phones from the aughts, has more than doubled over the past week — even as the company has stated there aren’t any changes in its business that would account for a boost.

Another cell company to be graced by crowd wisdom is Nokia, whose stock rose by 42 percent on Thursday — the firm’s biggest one-day percentage gain since it began trading in 1991.

Good news for longtime investors in penny candy: The chocolate taffy maker Tootsie Roll saw a 14 percent gain on Wednesday — with its share price growing from $30.14 late last week to $42.85 today.

Blockbuster, or the remainder of the firm responsible for liquidating its assets, saw gains as high as 700 percent on Tuesday — despite the fact that there’s only one physical store in existence as of 2019.